9 Key roles of managers in banking employee engagement: Trust, performance, retention

In banking, engagement is rarely lost because leaders do not care. It is usually lost in the middle. A policy is announced, a target is revised, a new compliance rule rolls out, and somewhere between intent and execution, energy drops. Employees do not disengage from the bank. They disengage from how work feels day to day.

That daily experience is shaped almost entirely by managers.

Managers decide how pressure is communicated, how fairly workloads are distributed, how feedback is handled, and whether change feels manageable or overwhelming. Two branches in the same bank can show completely different engagement levels, even with identical systems, incentives, and policies. The difference is often the manager.

Understanding the role of managers in banking employee engagement means looking beyond programs and surveys. It means examining how managers translate strategy into reality, especially in high-stakes, high-regulation environments where trust, clarity, and consistency matter more than motivational speeches.

- Banking employee engagement breaks in execution, not intent, and managers shape how work feels day to day under pressure.

- The role of managers in banking employee engagement centers on clarity, fairness, feedback follow-through, and absorbing stress during change.

- Well-managed banking teams show stable engagement through clear communication, visible ownership, routine listening, and consistent leadership behavior.

- Motivation creates short spikes, but engagement sustains performance, trust, and customer outcomes across ongoing banking operations.

- Tracking the right engagement KPIs helps managers spot early risk signals and protect retention, performance, and service consistency.

What is the role of managers in banking employee engagement?

A manager’s role in engagement is like a control tower, not the aircraft. They do not create every condition, but they guide movement, reduce friction, and prevent small issues from becoming costly disruptions. In the banking sector, where pressure is constant, managers shape how work feels long before results appear.

Managers in financial institutions prioritize employee engagement by translating senior leadership intent into daily actions. They set expectations, handle employee feedback, and apply engagement strategies that help bank employees stay focused, supported, and consistent under regulatory and customer pressure.

They also influence employee satisfaction by deciding what gets attention and what gets ignored. When managers listen, act, and close loops, engaged employees emerge naturally across financial services teams, without relying only on incentives or top-down messaging.

Managers anchor the workforce engagement strategy for banks by choosing tools and rhythms that fit reality. With the right employee engagement software, they turn feedback into steady improvement instead of one-off initiatives.

9 Key roles of managers in banking employee engagement

The role of managers in banking employee engagement is like a relay baton, not a spotlight. Outcomes move only when handoffs are clean, timed, and trusted. In the banking sector, managers convert intent into execution, balancing people, pressure, and precision while keeping teams steady, compliant, and focused on long-term business outcomes.

1. Communication & expectation setting

In the role of managers in banking sector, clear communication shapes engagement before motivation ever matters. Managers translate senior leadership priorities into simple daily direction, align key performance indicators with real tasks, and reduce employee engagement challenges in banking sector by removing confusion early. This clarity directly supports organization’s success, customer satisfaction, and predictable business outcomes.

2. Coaching & development

Strong bank manager skills show up in how managers grow skilled employees, not how fast targets are pushed. Through regular coaching, managers build capability, confidence, and judgment in bank employees, which improves employee morale and retention. Over time, this development focus strengthens business success by creating resilient teams ready for regulatory and customer pressure.

3. Recognition & feedback

Recognition works when it is timely, specific, and linked to effort, not just outcomes. Managers use employee input, everyday appreciation, and employee engagement surveys to show people they are seen. This reinforces employee morale, encourages consistent behavior, and links individual contribution to broader business outcomes without relying only on incentives.

4. Empowerment & autonomy

Engagement rises when managers trust teams to act within clear boundaries. By empowering decision-making while maintaining operational risk management, managers protect customer relationships and customer satisfaction. This balance helps bank employees feel ownership without exposure, improving confidence, speed, and accountability across financial services operations.

5. Building trust & care

Building trust and engagement in BFSI organizations depends less on promises and more on consistency. Managers earn trust by being fair, predictable, and present during pressure periods. When employees feel supported, engagement stabilizes, employee morale improves, and business outcomes remain steady even during audits, escalations, or regulatory change.

6. Well-being & support

Managers directly influence stress levels by how work is planned and how pressure is absorbed. By monitoring workloads, listening to early signals, and adjusting expectations, managers protect employee morale and sustain performance. This support reduces burnout risk and keeps teams effective, focused, and aligned with long-term business success.

7. Championing feedback channels

Measuring employee engagement only works when managers close the loop. Managers promote employee engagement surveys, encourage honest employee input, and act visibly on results. Using employee engagement KPIs for financial services, they turn feedback into action, reinforcing trust and showing engagement is tied to real decisions.

8. Performance alignment & goal clarity

Managers connect daily actions to key performance indicators so work feels purposeful. Clear alignment helps bank employees see how effort contributes to the organization’s success and business outcomes. This clarity reduces friction, improves focus, and strengthens engagement without adding pressure or complexity.

9. Change leadership & stability

During change, managers become anchors. By explaining what is changing, what is not, and why it matters, managers reduce uncertainty. This steady leadership protects employee morale, supports customer satisfaction, and ensures the role of managers in banking employee engagement remains central during transitions.

Access a practical survey to measure manager effectiveness in banks

Download nowWhen these roles are executed consistently, engagement stops being abstract and becomes visible in daily behavior. The next section explores what employee engagement looks like in well-managed banking teams, where trust, clarity, and results reinforce each other.

What employee engagement looks like in well-managed banking teams

Employee engagement in banking teams is like a well-run airport terminal. You notice flow, not friction. Things move smoothly because signals are clear, people know where to go, and small issues are handled before delays compound.

In banks, that smoothness appears when the manager's intent consistently shapes daily behavior, not just outcomes.

- Clear signals, low noise: Frontline managers in banking engagement create clarity amid banking workforce communication challenges. Employees feel informed, not overloaded, because expectations are repeated, priorities are stable, and employee sentiment stays steady. This manager's impact on employee engagement in banks reduces confusion, errors, and stress without adding meetings or processes.

- Visible ownership and follow-through: In well-managed teams, banking manager engagement responsibilities show up as action, not promises. Leaders gain insight from employee sentiment and act quickly, directly improving employee morale in financial institutions. This consistency strengthens trust, protects the employee value proposition, and lowers retention risk across corporate employees.

(Source: Gallup)

- Engagement measured, not guessed: Measuring employee sentiment in financial services becomes routine, not reactive. Managers track employee engagement KPIs and key metrics regularly, helping banking industry leaders spot early signals. This discipline helps improve employee engagement while linking people data directly to competitive advantage and business outcomes.

- Purpose felt at the frontline: Employees feel how their work matters because the leadership role in financial services engagement connects effort to impact. Clear direction, fair workload, and support help improve employee engagement organically. Over time, this alignment strengthens morale, stability, and long-term team performance.

These patterns reveal why engagement feels stable in some teams and fragile in others. To understand this difference clearly, the next section breaks down the difference between motivation and engagement, and why confusing the two leads to short-lived results.

The difference between motivation and engagement

Motivation is like caffeine. It gives quick energy, sharper focus, and short bursts of effort. Engagement is like sleep. It restores judgment, consistency, and resilience over time. In banking operations, leaders often chase motivation to hit sales targets, while engagement determines whether performance holds under pressure, customers, and complexity.

That difference is why choosing the right listening approach matters, including how to choose employee survey software for banks that captures engagement trends early, not after damage is done.

Once this difference is clear, the value of strong managers becomes visible. The next section explores five benefits of improved manager effectiveness in banking teams, showing how engagement drives stability, performance, and customer outcomes together.

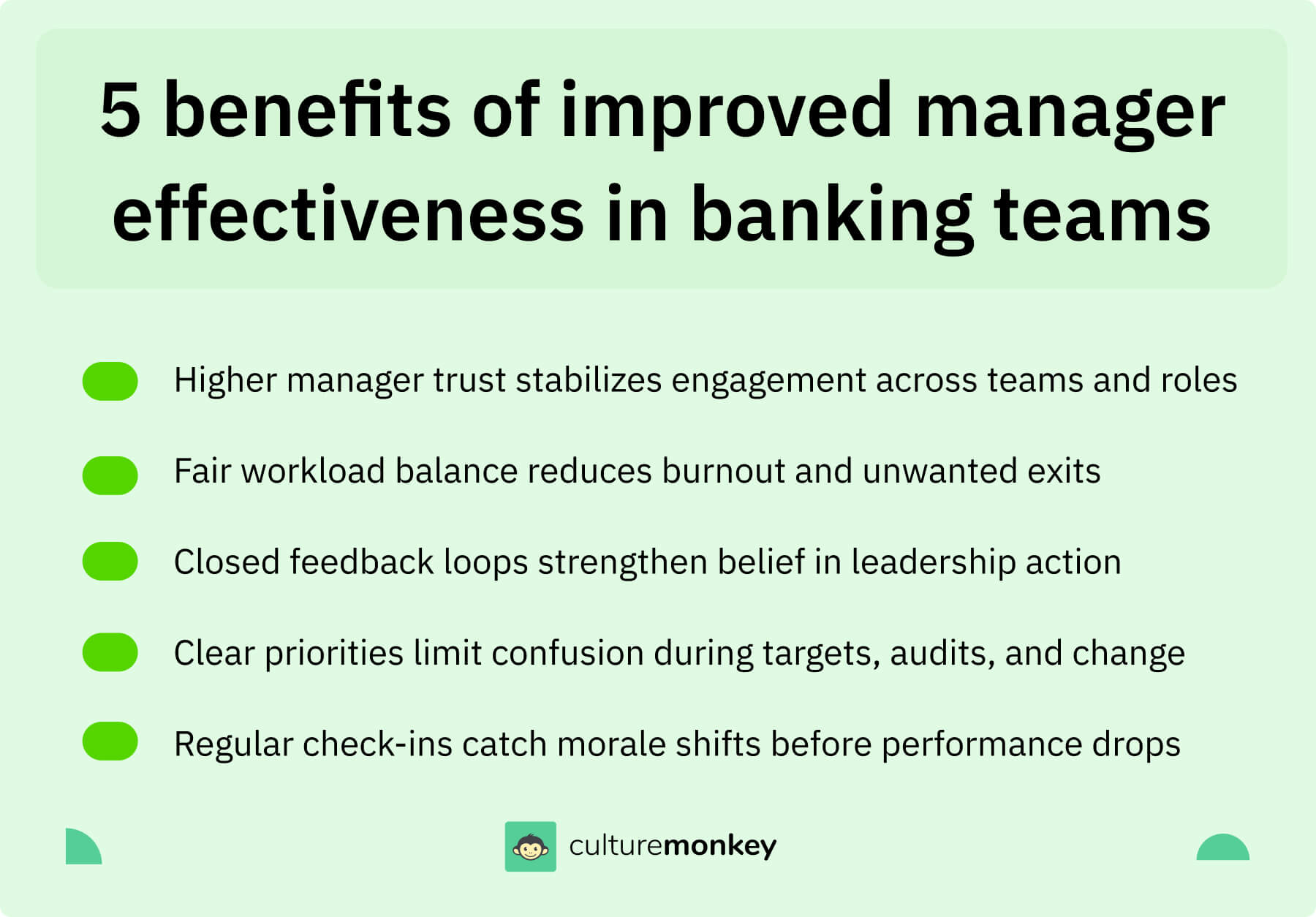

5 benefits of improved manager effectiveness in banking teams

Manager effectiveness in banking teams is like a strong router in a busy network. When it works, everything flows without drama. When it fails, small delays turn into bigger outages. In banking institutions, better people management in financial services improves employee experience first, then employee performance and financial performance follow across the banking industry.

1. Higher employee retention and lower attrition in banking roles

In tight labor markets, improving employee engagement in banks reduces churn by making work clearer and supporting more consistent performance. Engagement data shows early retention risk, helping business leaders develop strategies that protect continuity, service quality, and long-term organizational objectives.

2. Better customer experience driven by engaged frontline staff

When managers coach and remove blockers, employee experience improves, and employees show up calmer and more prepared. That consistency strengthens customer interactions, lifts service reliability, and supports financial performance. It also helps teams align daily behavior with organizational objectives in banking industry realities.

3. Stronger compliance and reduced operational risk

Effective managers reinforce routines, escalation habits, and clean handoffs, reducing preventable errors. They use banking workforce engagement metrics and engagement data to spot stress points that cause shortcuts. This supports organizational objectives by lowering incident exposure and keeping banking institutions audit-ready.

4. Improved productivity and performance across banking teams

Clear direction and a fair workload improve employee performance without burning people out. Managers use KPIs for banking managers to focus effort on the work that moves outcomes. Cross-departmental shadowing programs also help build coverage and speed, especially in high-volume roles.

5. Healthier workplace culture and manager effectiveness

When managers listen, act, and follow through, norms improve quickly. Employee engagement KPIs for financial services make this visible, tying culture to engagement data and employee experience trends. Over time, teams collaborate better, and business leaders can develop strategies with less resistance.

These benefits only stay real when they are measured, not assumed. The next section breaks down the employee engagement KPIs for financial services managers should actually track, so banking institutions can connect engagement data to performance and risk.

Employee engagement KPIs for financial services managers should actually track

Engagement KPIs are like an early warning system on a cockpit dashboard. You do not stare at one gauge. You watch the signals that change first, so you can correct course before performance drops. For bank leaders, the right KPIs show whether employees feel supported, and whether today’s routines protect future success.

- Manager trust and support signal: Track whether employees feel supported by managers week to week, not just annually. When this dips, job satisfaction often follows. Use it as an early warning system for burnout, retention risk, and slipping customer behavior before it hits numbers.

- Quality of feedback and action closure: Measure how often employee input gets a visible response within a set window. When action closure improves, people see significant benefits and stay engaged. This also strengthens employees' ability to raise issues early, which reduces hidden risks and rework.

- Learning confidence and compliance ease: Track confidence in policies and training usefulness, not just completion. Gamified compliance training can lift participation, but the KPI should test whether people can apply it under pressure. This protects performance and reduces errors in real situations.

- Team connection and collaboration: Measure whether regular team building events actually improve cross-team help, handoffs, and support. The goal is not fun; it is smoother delivery. When collaboration rises, employees' ability to solve issues improves, which supports service consistency and future success.

- Role clarity and workload fairness: Track whether people understand priorities and feel the workload is fair. When clarity improves, job satisfaction rises, and missteps fall. For bank leaders, this KPI often predicts steadier output and fewer last-minute escalations.

Once managers know what matters, the next question is what most banks track today. The next section covers common employee engagement KPIs used in financial services today, and where they may miss early signals that managers need.

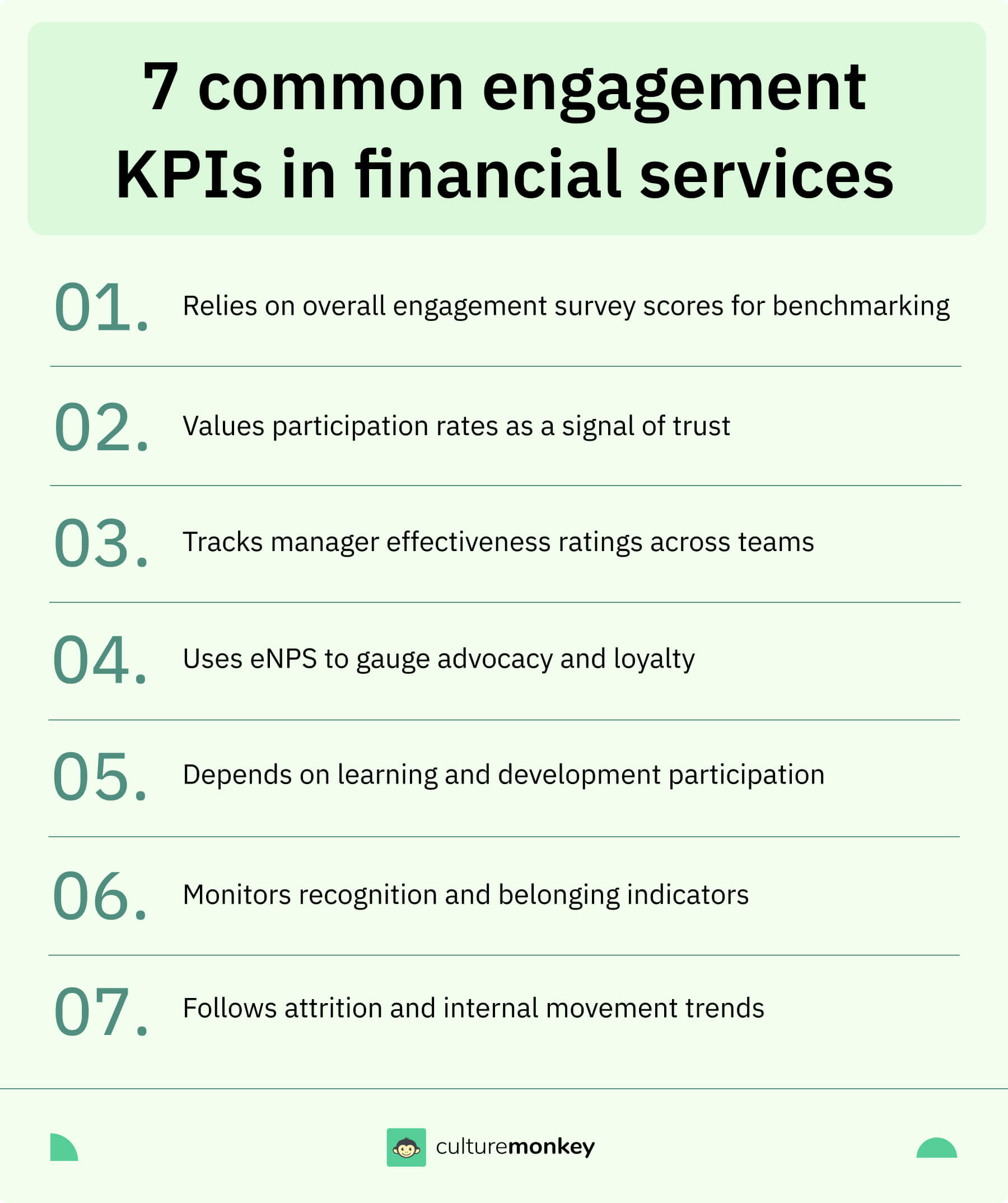

Common employee engagement KPIs used in financial services today

Common engagement KPIs are like a bank’s standard credit score model. They are useful, fast, and easy to compare, but they can miss context. In banking environments, leaders track what is measurable at scale, yet the most important signals often sit behind day-to-day behavior and clear communication.

- eNPS and advocacy: Measures whether banking teams would recommend the workplace culture to others. It is easy to benchmark, but it can hide local issues. Pair it with manager-level cuts to spot gaps between highly engaged teams and struggling teams.

- Engagement survey score and participation: Tracks overall engagement and response rate. High participation suggests trust, but low participation may signal fear or fatigue. In banking environments, this KPI is strongest when broken down by team, role, and tenure.

- Manager effectiveness rating: Captures how employees rate their manager’s support and clarity. It connects directly to clear communication, workload fairness, and follow-through. When this drops, customer complaints often rise because service quality becomes inconsistent at the frontline.

- Learning and professional development uptake: Tracks training completion, certification progress, and perceived growth. It can signal whether people see a path forward. Highly engaged teams often show stronger professional development momentum, especially when managers remove time and access barriers.

- Recognition and belonging signal: Measures whether people feel seen and included. This can be a pulse item or index. It is closely tied to meaningful relationships in banking teams, especially across functions where collaboration affects customer outcomes.

- Attrition and internal mobility: Tracks exits, transfers, and internal moves as a proxy for satisfaction and growth. It is lagging, but still important. Use it alongside survey signals to understand whether workplace culture is improving or simply losing dissatisfied employees.

These KPIs help, but they often sit too high-level for managers who need fast signals and clear next actions. The next section shows how CultureMonkey helps banking teams improve employee engagement at scale, without adding admin load.

How CultureMonkey helps banking teams improve employee engagement at scale

CultureMonkey is like a manager’s co-pilot for engagement. It keeps a steady view of what teams are feeling, flags what needs attention, and helps leaders respond without guessing. In financial organizations, scale breaks when engagement efforts rely on memory, not signals. This is where structured engagement initiatives become easier to run.

- Always-on listening with short pulses: CultureMonkey helps banking professionals run lightweight engagement initiatives that fit busy schedules. Regular pulses capture what changes week to week, so managers can boost morale early. This supports consistent engagement efforts without waiting for annual surveys.

- Dashboards that managers can act on: Managers and relationship managers get clear views of what is moving, so they can respond faster. This helps align employee development and coaching with what teams actually need. Better follow-through supports customer expectations and protects customer loyalty.

- Clear action planning after surveys: CultureMonkey supports turning feedback into specific actions with owners and timelines. This makes engagement efforts visible, not theoretical, across financial organizations. When teams see action, trust rises and morale improves.

- Support for development and mobility programs: Insights from pulses help leaders target employee development where it matters most. Teams can also use findings to inform cross departmental shadowing programs, improving collaboration and coverage. That stability improves service consistency for customers.

Conclusion

In the banking sector, engagement rarely breaks because of a missing intent or a weak strategy. It breaks where work actually happens. The role of managers in banking employee engagement sits at that exact intersection.

Managers shape how pressure is absorbed, how change is explained, and how people experience their day long before results appear on dashboards. When managers are clear, consistent, and supported, engagement becomes steady rather than reactive. When they are not, even the best programs struggle to land.

This is where CultureMonkey plays a critical role. It helps organizations move engagement out of annual rituals and into everyday management. By giving managers simple, continuous signals and clear next actions, CultureMonkey makes engagement measurable, visible, and manageable at scale.

Leaders gain insight early, teams feel heard, and managers are no longer guessing what matters. In banking, where trust, consistency, and execution define success, enabling managers with the right engagement system is not optional. It is foundational to performance, retention, and long-term resilience.

Book a demo with CultureMonkey!

FAQs

1. Why do managers play such a big role in employee engagement in banking?

Managers shape the daily experience of banking employees more than policies or programs. They control workload balance, communication tone, feedback follow-through, and support during pressure. In regulated, high-stakes environments, employees engage or disengage based on how managers translate expectations into reality. This makes managers the strongest lever for sustaining trust, morale, and consistent performance.

2. What employee engagement KPIs should banking managers track regularly?

Banking managers should track manager trust, role clarity, workload fairness, feedback action rates, and short pulse sentiment trends. These KPIs act as early warning signals before performance or retention drops. Unlike lagging indicators, they show whether employees feel supported day to day, helping managers adjust expectations, coaching, and priorities in fast-moving financial services environments.

3. How can managers improve engagement in high-pressure banking environments?

Managers improve engagement by creating clarity before urgency builds. This means setting priorities early, pacing expectations, closing feedback loops, and absorbing pressure instead of pushing it downward. In high-pressure banking environments, engagement improves when managers protect recovery time, explain the why behind change, and respond consistently, even when targets, audits, or customer demand intensify.

4. What’s the difference between HR-led engagement and manager-led engagement in banks?

HR-led engagement designs programs and measures outcomes, while manager-led engagement shapes daily behavior. HR sets direction, but managers determine whether engagement feels real. In banks, engagement fails when ownership stays centralized. It succeeds when managers act on feedback, reinforce fairness, and make engagement part of everyday leadership, not a periodic initiative.

5. How often should managers review employee engagement KPIs in financial services?

Managers should review employee engagement KPIs at least monthly, and again after audits, target resets, or staffing changes. Banking work shifts fast, so quarterly reviews can be too slow. A short monthly check of sentiment, workload fairness, and manager trust lets leaders act early, adjust coaching, and prevent small dips from becoming retention risk or service inconsistency.

6. Can employee engagement KPIs really predict retention in banking teams?

Often, yes. Engagement KPIs flag patterns before exits appear: falling manager trust, rising workload strain, and weaker belief that feedback leads to action. In banking teams, these shifts reduce job satisfaction and can affect customer experience first. Tracking them alongside movement data helps managers intervene early, support skilled employees, and reduce avoidable attrition in critical roles.