15+ Banking workforce communication challenges holding teams back

If you have ever planned a group vacation where everyone booked their own flights, you know how messy things can get. One person shares a detailed itinerary, another skims it, someone assumes the plan stayed the same, and someone else follows an outdated version saved on their phone. Everyone is trying to be helpful, yet confusion creeps in quietly. Not because the plan was bad, but because alignment was never truly confirmed.

Banking workforce communication challenges work in much the same way. Information is shared, forwarded, stored, and discussed, but understanding does not always travel with it. Messages move fast across systems and hierarchies, while assumptions fill the gaps left behind.

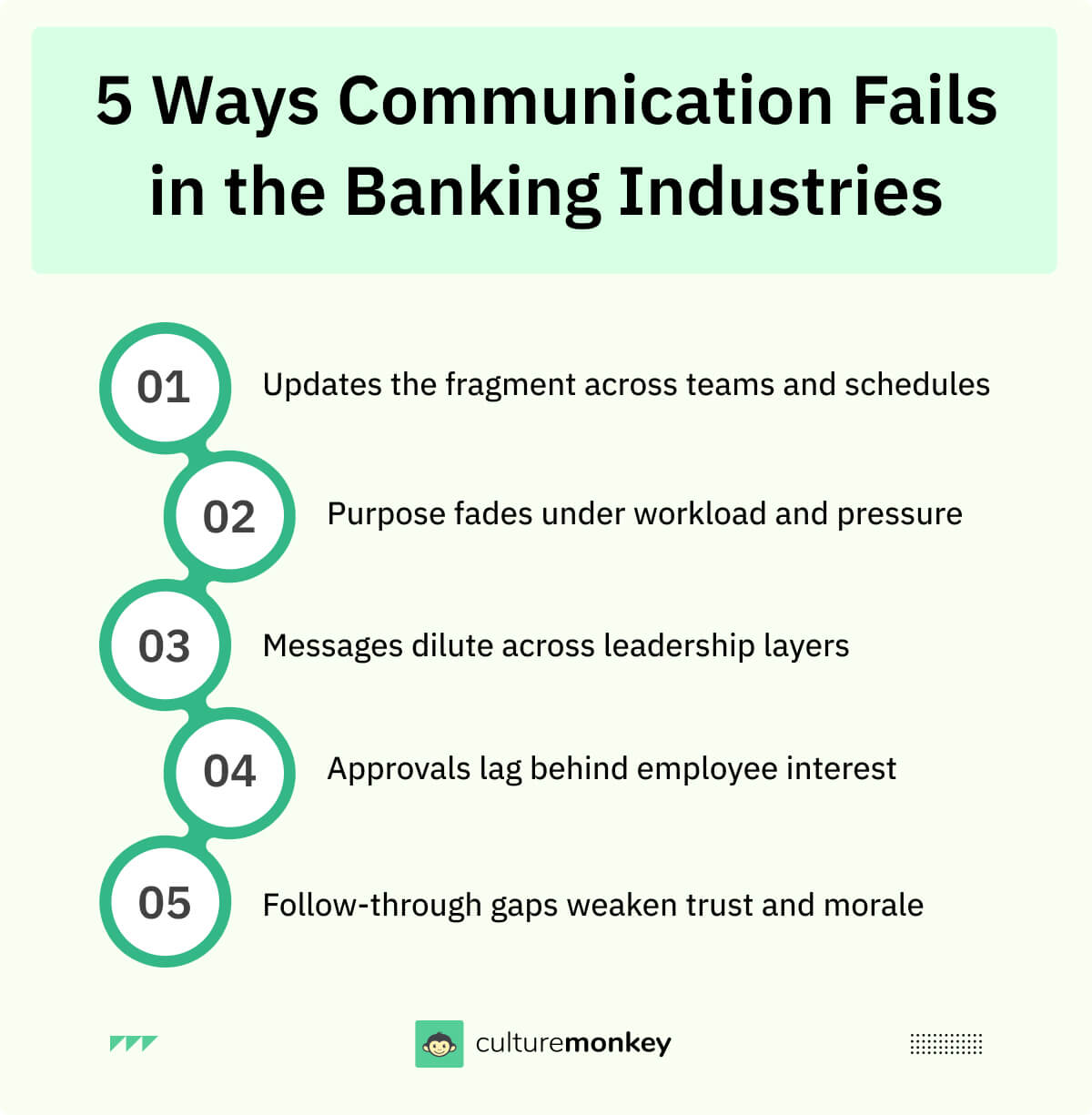

- Banking workforce communication challenges persist because legacy systems, siloed channels, and regulatory pressure prevent clear, timely information flow across roles and locations.

- Frontline and branch teams face greater gaps than corporate teams due to limited access, inconsistent channels, and delayed feedback loops.

- Poor communication directly affects morale, engagement, retention risk, and customer outcomes in the banking industry.

- Modern finance teams need shorter, clearer, multi-channel communication aligned with how people actually read and act today.

- Consistent listening, visible follow-through, and structured measurement are essential to strengthen engagement and communication at scale.

What do banking workforce communication challenges mean?

Banking workforce communication challenges are like driving with multiple navigation apps open, each giving slightly different directions. Banking employees move fast, but signals clash as digital banking challenges and rising customer expectations collide. In financial institutions, clarity breaks when messages travel faster than shared understanding, creating some of the biggest challenges facing banking industry leaders today.

Workforce communication in banking sector often stretches across tools, policies, and approvals. Internal communication challenges in banks mean banking employees may receive updates late or incompletely. These communication issues in financial institutions quietly affect business outcomes as decisions slow and assumptions replace clarity.

For financial institutions, the risk is cumulative. Banking employees experience confusion that shapes employee satisfaction and trust. In the financial services industry, misaligned messages ripple outward, missing customer expectations and weakening business outcomes. Clear communication is not volume; it is consistency, timing, and shared meaning across banking employees.

Internal communication challenges facing the financial services industry

Internal communication in the financial services sector is like running a busy branch lobby during a core-system upgrade: every message needs timing, clarity, and one source of truth. When that breaks, banking leaders spend time chasing alignment rather than making decisions.

Small gaps multiply into daily delays, mistakes, and uneven service.

Unclear communication from management

Manager communication in banking organizations can sound clear at the top and vague in the middle. Banking leaders interpret goals differently, so senior leadership sees alignment while teams see conflicting priorities. Leadership communication drives engagement when it spells out the decision, the owner, the deadline, and what stays unchanged today.

Outdated technology

Outdated technology forces financial services companies to patch updates across email, chat, portals, and spreadsheets. That weakens change communication in banks, because the latest version is hard to find and verify. Banking leaders repeat themselves, while employee sentiment drops as banking employees rely on screenshots, forwarded threads, and hearsay daily.

Siloed teams and reaching frontline workers

Siloed teams create gaps between risk, ops, product, and branch networks. Frontline staff communication in banks suffers because each group uses a different system and language. Banking leaders miss early warning signs, and prioritizing employee engagement gets harder because banking employees cannot see how their work connects to business success or engagement strategies.

Lack of engagement and morale

Employee morale in financial institutions dips when updates feel one-way and impersonal. Banking employee engagement challenges grow when banking leaders share rules without reasons or make changes without support. A stronger employee value proposition shows up when leaders explain the why, offer simple next steps, and follow up on employee sentiment.

Crisis communication preparedness

During incidents, speed matters, but consistency matters more. Under compliance pressures, banking leaders need a simple escalation path, approved templates, and one spokesperson per topic. That protects employee attitude and helps deliver superior customer service, because financial services employees know what to say, what not to say, and where to direct questions.

There’s no central communications hub

When there is no central hub, updates scatter across inboxes, portals, and meeting notes. Banking leaders spend time forwarding the same message, while teams lose confidence in what is current. Engagement strategies work better when prioritizing employee engagement, including one searchable place for decisions, FAQs, and change communication in banks.

Information overload

Information overload is not a volume problem; it is a sorting problem. Banking leaders flood channels, yet the critical items still get missed. Prioritizing employee engagement means labeling what is urgent, what is optional, and what requires action now. Clear summaries and engagement strategies lift employee attitude, protect business success, and steady customer expectations.

Inconsistent channels

Inconsistent channels create inconsistent meaning. A policy in email, a tweak in chat, and a reminder in a meeting rarely match perfectly. Leadership communication in financial services works when banking leaders standardize where final decisions live and how confirmations happen. That reduces rework and supports business success across accountancy companies.

Lack of feedback

Without feedback loops, senior leadership learns about friction after it hits customers and branch queues. Banking leaders need lightweight, regular check-ins that capture employee attitude and show follow-through. Prioritizing employee engagement becomes real when responses trigger visible fixes. These engagement strategies strengthen the employee value proposition and improve business success.

Regulatory compliance

Compliance communication challenges in banking spike when rules change quickly, and teams get partial context. Under compliance pressures, banking leaders must translate requirements into plain actions, owners, and timelines. This is especially true when the updates its interpretations. Clear trails protect audits and business success without overwhelming frontline staff communication in banks.

Security concerns

Security messages often compete with daily tasks, so they get skimmed. Banking leaders should connect security steps to customer expectations and superior customer service, not just risk avoidance. Leadership communication engagement occurs when it gives short, repeatable behaviors and explains consequences. This supports business success while reinforcing the employee value proposition.

Consumer Protection Act

When the Consumer Protection Act guidance shifts, feedback culture in banking workplaces, wording differences can create big downstream confusion. Senior leadership should align banking leaders on one interpretation, then repeat it through the same channel and cadence. Pair the rule with examples that match customer expectations. This improves change communication in banks and protects business success.

These challenges do not stay in messages. They shape employee engagement in financial institutions and superior customer service as customer expectations rise. Next, we shift to a workforce engagement strategy for banks that leaders use to drive business success.

15+ Strategies to strengthen morale and communication in finance teams

Strengthening morale in finance teams is like recalibrating a live trading dashboard while markets stay open. Every adjustment affects confidence, timing, and outcomes. In financial services, mobile banking demands and rising customer expectations leave little margin for confusion.

These strategies address employee engagement challenges in banking sector, focusing on steady signals, clearer conversations, and practical actions that help leaders in building trust and engagement in BFSI organizations without overwhelming teams.

1. Promote work-life balance

Promoting work-life balance in financial services means designing workloads around real peak cycles, not constant urgency. When banking institutions protect recovery time, employee engagement in financial institutions improves.

Engaged employees stay focused during audits, mobile banking rollouts, and customer spikes. This balance helps corporate employees deliver consistent customer service and supports the organization’s success without burnout becoming normalized.

2. Try team bonding activities

Team bonding activities should fit regulated environments, not feel forced. Short employee engagement activities like rotating problem-solving huddles help credit unions and financial organizations build trust.

These moments strengthen employee experience and frontline staff communication in banks. Over time, engaged employees collaborate better, improving customer experience and customer loyalty across the accountancy industry.

3. Build a positive workplace culture

A positive culture shows up in everyday interactions, not slogans. Clear manager communication in banking organizations reduces friction and confusion.

When leaders model openness, employee experience improves, and banking employee engagement challenges soften. This consistency supports business initiatives, strengthens customers, and reinforces long-term success.

4. Mentorship programs

Mentorship programs connect experience with confidence. Pairing loan officers and newer hires improves knowledge sharing across products, risk, and compliance. In credit unions and accountancy companies, mentorship strengthens employee experience and reduces errors.

Engaged employees feel supported, which improves employee engagement and customer experience while keeping regulatory compliance practical and human.

5. Communicate with employees often

Frequent communication works best when it is predictable and purposeful. In financial services, regular updates help corporate employees anticipate changes instead of reacting late.

This improves employee engagement and reduces uncertainty during mobile banking launches or policy shifts. Clear rhythms from banking leaders support engaged employees, customer satisfaction, and smoother execution of business initiatives.

6. Ensure transparent communication

Transparent communication explains decisions, tradeoffs, and constraints in plain language. Leadership communication in accountancy builds trust when teams understand why changes happen.

This approach improves employee experience and reduces banking employee engagement challenges. In many financial institutions, transparency helps engaged employees focus on customer experience while meeting regulatory compliance without second-guessing leadership intent.

7. Career development

Career development must reflect real paths within financial organizations. When corporate employees see growth tied to skills, employee engagement improves.

Credit unions often map roles across service, digital, and risk, strengthening employee experience. This clarity helps improve employee engagement, retain engaged employees, and align personal growth with customer satisfaction.

8. Implement flexible work arrangements

Flexible work arrangements help financial employees manage life demands without lowering standards. Clear guardrails protect regulatory compliance while supporting employee engagement. In banking institutions, flexibility reduces stress during peak mobile banking periods.

This balance improves employee engagement and helps engaged employees deliver a consistent customer experience and customer satisfaction across channels.

9. Recognize and reward achievements

Recognition should highlight behaviors that support customer experience and compliance, not just output. Simple engagement activities like peer acknowledgments reinforce priorities and clarify the role of managers in banking employee engagement.

In credit unions, recognition improves employee engagement and builds trust. Over time, engaged employees repeat the right behaviors, strengthening customer satisfaction, customer loyalty, and alignment with employee engagement KPIs for financial services and business initiatives.

10. Build trust through transparency

Trust grows when senior leaders explain decisions and visibly follow through. In financial services, this consistency reduces banking employee engagement challenges and improves employee attitude.

When banking leaders communicate clearly during change, engaged employees stay focused. Trust supports employee experience, steadies the customer journey, and protects success during uncertainty.

11. Collect feedback regularly

Regular employee feedback acts as an early warning system. Short, frequent check-ins help improve employee engagement and surface issues before they escalate. Financial organizations that close feedback loops build credibility.

Engaged employees feel heard, team spirit improves, and leaders gain insight to protect customer satisfaction and business initiatives more effectively.

12. Community service projects

Community service projects can double as meaningful engagement initiatives when participation is voluntary. Credit unions often align efforts with local needs, boosting customer trust.

For corporate employees, shared purpose improves employee experience and morale. These initiatives strengthen engaged employees’ connection to the organization while reinforcing trust and customer satisfaction.

13. Embrace diversity and inclusion initiatives

Inclusive communication simplifies language and reduces assumptions. This improves frontline staff communication in banks and the customer journey. Diverse perspectives help engaged employees flag risks earlier.

Inclusion strengthens employee experience and morale, while helping financial organizations serve broader customer expectations effectively.

14. Encourage team collaboration

Collaboration improves when roles and handoffs are clear. A finance leadership engagement framework helps banking leaders define ownership and escalation. In credit unions, this reduces duplication and confusion.

Engaged employees collaborate with confidence, improving employee experience, customer journey, and execution of business initiatives across financial services.

15. Financial wellness programs

Financial wellness programs address the stress that many corporate employees hesitate to admit. Practical support plays a key role in improving employee morale in financial institutions and supports engagement.

In the finance industry, this stability helps engaged employees stay focused during audits and customer surges. Over time, measuring employee sentiment in financial services connects stronger morale to better customer service and a more consistent customer experience.

(Source: Axios HQ )

16. Focus on inclusive communication

Inclusive communication ensures messages reach everyone clearly. Standard templates help banking leaders reduce mixed interpretations.

Leadership communication drives engagement when updates are accessible and consistent. In many financial institutions, this improves employee experience and protects the customer journey during regulatory compliance changes.

17. Foster a positive work environment

A positive environment removes small daily blockers that frustrate teams. Fixing unclear links, slow approvals, and missing context improves employee experience.

In financial services, these changes help improve employee engagement more than large programs. This delivers steadier customer service and a stronger organization’s success.

18. Invest in employee education

Employee education should reflect real scenarios, not generic training. In financial services, practical learning supports regulatory compliance and customer experience. Educated individuals handle mobile banking questions with confidence.

This investment improves employee morale, strengthens workers' experience, and supports long-term business initiatives and customer loyalty.

Assess banking workforce communication challenges with targeted questions

Download nowOnce these engagement strategies are in motion, leaders need clear visibility into employee sentiment and employee feedback.

The next section explains how CultureMonkey helps financial services teams and credit unions measure engagement, guide action, and sustain business success.

How CultureMonkey enables stronger employee engagement in financial institutions

Using CultureMonkey in financial institutions is like installing a clear dashboard in a fast-moving cockpit. Signals already exist, but leaders need them organized, timely, and readable. In the finance industry, consumer needs, compliance culture, and daily pressure make guessing risky.

- Actionable employee surveys: CultureMonkey helps banking teams capture regular feedback so banking professionals see what employees feel, not assumptions. This supports the finance workforce engagement strategy, highlights common engagement pitfalls, and helps leaders boost morale while measuring engagement across finance shifts without disrupting daily work.

- Clear engagement insights for leaders: CultureMonkey translates survey data into simple insights that banking professionals can act on. This supports business strategy, helps employees understand priorities, and strengthens ethical culture. Leaders use this clarity to boost morale and align engagement participation with market demands.

- Support for frontline voices: CultureMonkey enables finance frontline engagement best practices by collecting input from different roles and shifts. Banking professionals gain visibility into employee experience across banking teams. This helps employees feel supported, improves employee wellbeing, and builds a compliance culture grounded in real frontline signals.

- Closing the feedback loop: CultureMonkey makes it easier for leaders to respond visibly to employee feedback. Banking teams can show what changed and why, which helps with trust. This approach strengthens ethical culture and supports future success by reinforcing that engagement efforts lead to action.

- Consistent engagement measurement: CultureMonkey supports measuring engagement across finance shifts with structured surveys and trend tracking. Banking professionals spot patterns early, avoid common engagement pitfalls, and protect customer interaction quality. Over time, this consistency builds competitive advantage for traditional banks and credit unions alike.

- Alignment with regulated environments: CultureMonkey fits the finance industry by focusing on listening, clarity, and follow-through rather than distractions. It supports compliance culture, helps banking teams stay aligned, and enables leaders to balance managing risks with employee experience and stronger customer relationships.

- Foundation for long-term growth: By grounding engagement in data, CultureMonkey helps banking professionals connect people insights to business strategy. Employees feel supported when leaders act on signals. This steady approach boosts morale, supports future success, and helps financial institutions adapt confidently to consumer needs.

Conclusion

Banking workforce communication challenges matter because modern banking environments leave little room for confusion, silence, or mixed signals. In banking environments, when messages travel unevenly across business units and digital channels, employees feel uncertain, job satisfaction drops, and retention risk quietly rises. Over time, engaged teams fragment, productivity metrics stall, and financial outcomes suffer even when strategies look strong on paper.

In healthy banking environments, employees feel informed, supported, and confident in how their work connects to outcomes. That sense of clarity improves job satisfaction, reduces retention risk, and builds an ownership mindset across teams. It also helps employees feel ready to serve customers consistently, even as banking environments evolve.

CultureMonkey helps organizations address this by turning employee voice into action. Through structured listening, data analytics, and clear follow-through, leaders spot engagement gaps early, strengthen professional development conversations, and rebuild trust. The result is engaged teams, lower retention risk, smarter decisions, and innovative solutions that scale across complex banking environments.

Book a demo with CultureMonkey.

FAQs

1. What are the most common communication challenges in the banking workforce today?

In the banking sector and banking industry, communication often breaks down due to fragmented updates, overloaded inboxes, and unclear priorities. Banking industry teams struggle to align across roles, while banking sector leaders lack real-time visibility. Weak feedback culture in banking workplaces and missing digital communication tools for banks reduce clarity, hurting engagement, trust, and coordination across fast-moving environments.

2. Why does communication break down between frontline staff and managers in banks?

In the banking sector, gaps emerge when frontline realities fail to reach decision-makers. Banking industry managers rely on reports, while frontline teams depend on shift-based updates. Without structured employee feedback processes in finance plants and digital communication tools for banks, signals weaken. This limits finance manager effectiveness and engagement, increasing friction, absenteeism risk, and misunderstanding across roles.

3. How do compliance and regulations affect communication in banking teams?

In the banking industry, heavy regulations shape how messages are framed, approved, and delivered. Banking sector teams often delay updates to avoid errors, causing confusion. Without gamified compliance training and clear workflows, compliance feels restrictive. This slows feedback culture in banking workplaces, reduces finance workforce motivation techniques, and weakens understanding across regulated operations.

4. What communication challenges do branch-based banking teams face compared to corporate teams?

Branch teams in the banking sector operate on schedules and customer demand, unlike corporate teams. Banking industry communication often favors email-heavy formats, excluding branches. Limited communication tools for banks and inconsistent updates block alignment. This disconnect affects finance workforce engagement metrics, reduces trust, and makes regular team-building events harder to coordinate meaningfully.

5. How do poor communication practices impact employee engagement in banks?

In the banking industry, unclear communication lowers confidence and purpose. Banking sector employees disengage when updates lack context or follow-up. Weak feedback culture in banking workplaces prevents course correction. Over time, this hurts finance workforce engagement metrics, reduces absenteeism in the finance workforce, and undermines long-term motivation across customer-facing and operational roles.

6. How does digital transformation affect bank communication?

Digital transformation reshapes the banking sector by multiplying channels and speed. In the banking industry, tools enable reach but also overload teams. Without intent, digital communication tools for banks scatter messages. Leaders must pair technology with finance workforce motivation techniques and employee feedback processes in finance plants to maintain clarity and shared understanding.

7. Why leadership communication matters in banking teams?

In the banking sector, leadership communication sets the tone and trust. Banking industry teams look to leaders for clarity during change. When leaders model transparency, support volunteer efforts, and reinforce feedback culture in banking workplaces, engagement rises. Strong communication improves finance manager effectiveness and engagement, aligning teams with priorities and customer expectations.

8. How do banks measure communication effectiveness?

Banks measure communication effectiveness by linking listening tools to outcomes. In the banking industry, surveys and pulse checks from top survey tools for finance companies track clarity, trust, and follow-through. Banking sector leaders combine finance workforce engagement metrics with qualitative feedback, ensuring communication improves coordination, reduces absenteeism, and supports consistent performance across teams.

9. How to choose employee survey software for banks?

To choose employee survey software for banks, prioritize tools built for regulated environments. Look for strong data security, anonymous feedback, multi-channel access for frontline staff, and clear analytics. The right platform should support frequent pulses, track trends over time, and help leaders act quickly while meeting compliance, audit, and governance requirements.