Measuring employee sentiment in financial services: a practical guide for banks and institutions

Measuring employee sentiment in financial services is not about feel-good scores or routine checklists. It is about noticing subtle signals before risk, burnout, or disengagement hardens into attrition, errors, or compliance gaps.

In regulated environments, silence is rarely neutral. It often signals uncertainty, fatigue, or hesitation to speak up.

When leaders learn to listen early, patterns surface sooner. Decisions remain calm, interventions stay small, and stability holds, even when external pressure continues to rise.

- Employee sentiment in financial services signals risk early, before issues show up as attrition, errors, or declining customer experience.

- Effective measurement blends direct feedback, behavioral signals, and technology, not one-off surveys or annual reviews.

- Regulation, hierarchy, and pace create unique challenges that suppress honest feedback without anonymity and trust.

- High-performing teams show consistent listening, manager follow-through, and clear links between sentiment, performance, and retention.

- Choosing the right listening tools determines whether feedback drives real change or becomes another ignored data point.

What does measuring employee sentiment in financial services actually mean?

Measuring employee sentiment in financial services means understanding how people actually experience their work, not just what they report in formal reviews. It combines employee sentiment, employee satisfaction, job satisfaction, and employee feedback to reveal how engaged employees feel across day-to-day realities inside financial institutions.

For financial services firms, measuring employee sentiment is to detect early shifts in trust, confidence, and clarity. Changes in employee sentiment, employee net promoter scores, and employee satisfaction help senior leadership understand whether policies, workload, or communication are strengthening or weakening alignment with business outcomes.

Most importantly, measuring employee sentiment connects people's signals to results. When financial institutions track employee sentiment consistently, patterns in employee feedback and job satisfaction surface before business outcomes are affected. This allows senior leadership to act early, retain engaged employees, and protect complex stability, regulated environments.

How financial institutions measure employee sentiment today

Financial institutions measure employee sentiment like layered risk exposure, not a single metric. Multiple listening methods work together to reveal how employees feel, where pressure builds, and what may quietly affect workplace culture, retention, and long-term business outcomes.

1. Direct feedback methods

Direct feedback methods are like hearing the engine while it is running, not after it stalls. They capture employee sentiment in real time by asking employees directly how they feel. In financial services, this immediacy matters because pressure, compliance, and pace can shift employee experience quickly and quietly.

Pulse surveys

Pulse surveys are like quick instrument checks in turbulence. You don’t wait for the plane to shake hard before you scan the dials. Small readings tell you where to steady course early.

In financial services, pulse surveys capture employee sentiment while decisions are still reversible. Try CultureMonkey pulse surveys to spot strain before it becomes normal.

Benefits:

- Capture frontline employee sentiment in banks quickly and repeatedly

- Support employee engagement in financial services through timely feedback

- Help hr leaders detect morale shifts before retention or customer satisfaction suffers

eNPS (Employee Net Promoter Score)

eNPS is like a quick temperature reading before you commit to a long hike. It won’t explain every ache, but it tells you whether the day feels safe or risky.

In financial services, that signal reflects employee sentiment and trust. Measure eNPS with CultureMonkey today to catch loyalty drops before retention starts leaking at scale.

Benefits:

- Benchmarks employee satisfaction trends over time

- Signals employee retention risk early for business leaders

- Complements engagement surveys with a clear loyalty indicator

One-on-one meetings

One-on-ones are like a quiet branch visit before closing time. Away from the lobby noise, people share what they held back, and you hear the real story, not the rehearsed one.

In financial services, these talks surface that employee sentiment surveys miss. Guide one-on-ones with CultureMonkey insights so managers act on patterns, not hunches, every week.

Benefits:

- Encourage honest employee feedback in financial institutions

- Strengthen workplace culture through trust-based conversations

- Help managers understand how employees feel beyond scores

Focus groups and open forums

Focus groups are like a roundtable after a tough client call. Once one person names the friction, others add missing detail, and the full picture forms faster than any solo note.

In financial services, this reveals workforce sentiment in the banking sector quickly. Validate themes with CultureMonkey analytics before you redesign the process or messaging at scale.

Benefits:

- Add context to quantitative data from employee surveys

- Surface workforce sentiment in the banking sector at scale

- Help hr teams validate patterns across engagement surveys

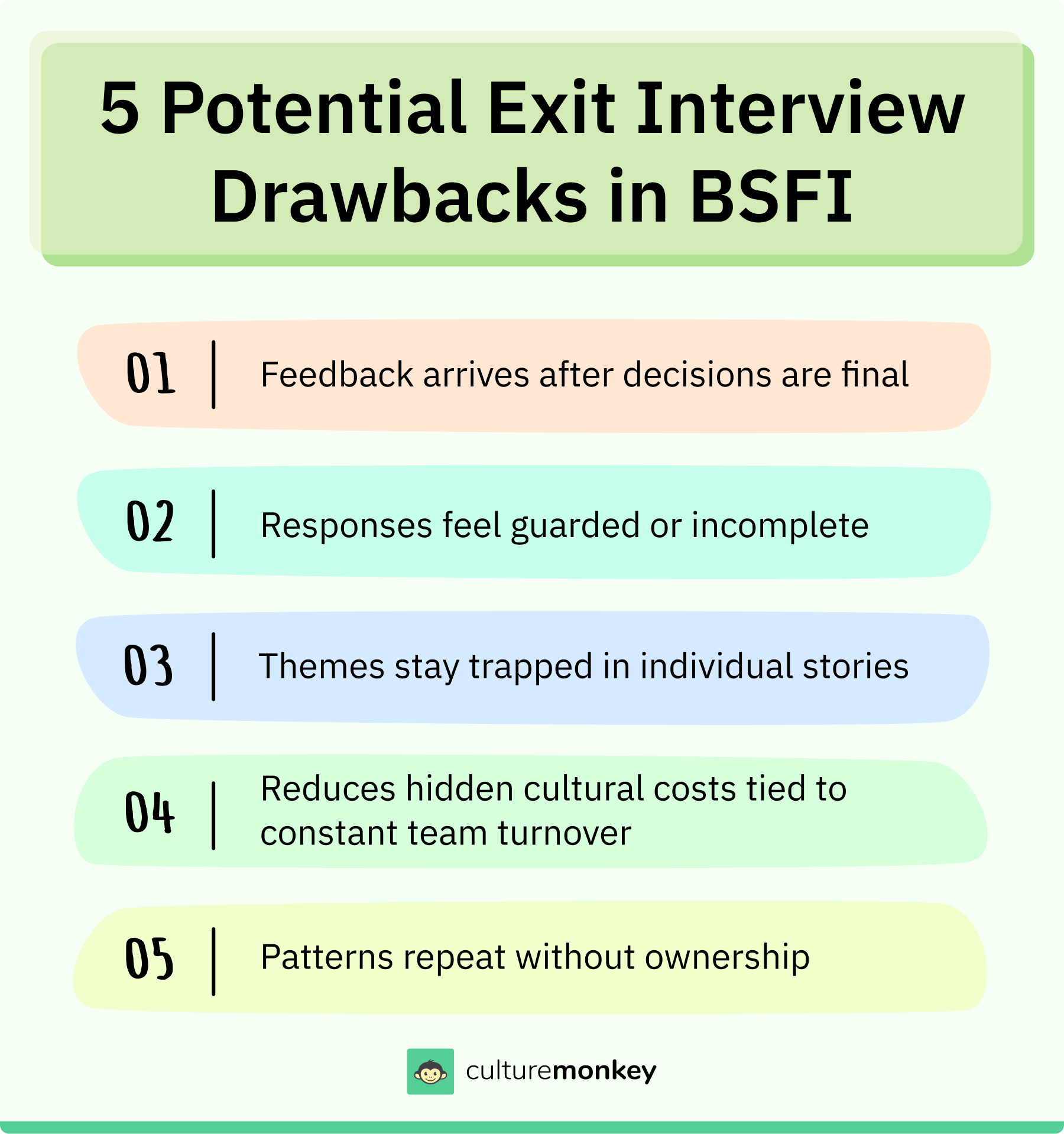

Exit interviews

Exit interviews are like reading the incident report after a near miss. You can’t undo the moment, but you can spot what kept repeating and what people stopped reporting.

In financial services, exit surveys map employee sentiment to retention risk. Analyze exits with CultureMonkey insights to fix patterns before the next wave leaves too soon.

Benefits:

- Identify root causes behind employee turnover trends

- Highlight gaps in professional development and engagement

- Inform improvements that support the long-term organization’s success

2. Indirect and behavioral metrics

Indirect and behavioral metrics are like reading movement on a trading screen rather than listening to commentary. They show how employees feel through actions, not words. In financial services, these signals often reveal employee sentiment earlier than direct feedback.

Turnover and absenteeism

Rising turnover and frequent absenteeism often signal declining employee sentiment long before formal feedback surfaces. In financial services, these patterns usually reflect sustained pressure, unclear expectations, or eroding trust. When absenteeism clusters or exits increase steadily, it often points to systemic strain rather than individual disengagement.

(Source: AON)

Productivity

Changes in productivity reflect how employees feel about workload, clarity, and support. In financial services teams, a gradual productivity dip often indicates disengagement building quietly. Even when employee surveys appear stable, reduced output or delayed execution can signal fatigue, confusion, or declining motivation beneath the surface.

Benefit usage

Shifts in benefit usage reveal changing employee needs and stress patterns. In financial services organizations, increased use of wellness programs, leave policies, or health benefits often indicates mounting fatigue. These trends provide indirect insight into employee experience, especially when combined with other behavioral signals over time.

Online reviews

Employee-written online reviews offer unfiltered sentiment signals outside internal systems. While external, repeated themes often mirror internal workforce sentiment in the banking sector. When similar concerns appear across roles or locations, reviews can highlight cultural or leadership issues employees hesitate to raise internally.

3. Technology-driven approaches

Technology-driven approaches work like signal processors. They analyze large volumes of feedback to surface patterns humans cannot spot easily. For large financial services firms, this scale is essential to understand employee sentiment accurately.

Sentiment analysis

Employee sentiment analysis uses machine learning and natural language processing to interpret open-text feedback. Instead of relying only on scores, it identifies emotional patterns, recurring concerns, and tone shifts across engagement surveys and employee comments, helping hr teams understand what employees actually feel.

Internal platforms

Internal platforms centralize employee surveys and feedback channels into one secure system. For financial services organizations, this enables compliant data collection, consistent listening, and clearer visibility into trends. These platforms turn scattered feedback into actionable workplace intelligence that leaders can trust.

4. Key principles for success

Key principles determine whether listening efforts create trust or silence. Without them, even well-designed engagement surveys fail. In financial services, these principles directly shape how employees feel about speaking up.

Anonymity

Anonymity protects honesty in regulated, high-stakes environments. Anonymous employee feedback for banks allows employees to share concerns without fear of retaliation. When anonymity is credible, response quality improves and employees feel safer raising issues tied to workload, leadership, or compliance pressures.

Action

Feedback without action erodes trust faster than silence. When employees see no follow-through, future participation drops. Acting on insights shows employees their input matters, reinforces workplace culture, and signals that listening is tied to real change, not symbolic exercises.

(Source: AON)

Consistency

Consistent listening builds credibility over time. Regular engagement surveys and visible follow-ups show commitment, not reactionary interest. In financial services, consistency helps hr leaders track employee sentiment trends, spot early shifts, and maintain trust even during periods of change.

Common employee sentiment challenges unique to financial services organizations

Employee sentiment in financial services is like steering with a fogged windshield. You can still move forward, but small blind spots become costly fast. In regulated organizations, pressure, audits, and constant change shape how employees feel.

That is why leaders must measure employee sentiment with the right balance of listening, speed, and follow-through.

- Compliance-first listening slows honesty: Regulatory-compliant employee surveys protect the organization, but they can make employees second-guess what to share. When feedback feels traceable, employee trust and sentiment in banks drops, and surveys collect safer answers instead of the full picture leaders need.

- Traditional methods arrive too late: Annual surveys and performance reviews rely on traditional methods that explain yesterday, not today. Without real-time employee sentiment tracking, leaders miss early friction that later hits work performance, well-being, and customer experience across organizations.

- Survey fatigue reduces signal quality: Too many surveys dilute feedback quality, even in high-engagement teams. Employees stop sharing details, skip questions, or rush responses. Banking workforce engagement metrics then look stable, while real concerns hide in missing context and weak sentiment data for financial services HR.

- Feedback sits in silos, not workflows: Organizations often collect feedback in multiple channels, then store it in separate tools. Without employee listening tools for financial services, HR teams struggle to connect surveys, comments, and outcomes into one view that drives meaningful changes.

- Managers struggle to act consistently: Even when employees share feedback, action depends on local follow-through. When leaders cannot measure employee sentiment by team, interventions become generic, and development opportunities feel uneven across organizations, weakening high engagement over time.

- Digital tools miss nuance without structure: Many organizations rely on digital tools to scale listening, but unstructured inputs create noise. Without an ultimate software layer that organizes themes, teams cannot compare surveys fairly or track continuous employee feedback in financial services with confidence.

- The right balance between speed and depth is hard: Financial services teams need quick signals and deep context. When organizations over-index on scores, they lose nuance. When they over-index on stories, they lose trend clarity. The right balance protects trust and improves work performance.

When employee engagement challenges in banking sector are handled well, organizations stop chasing scores and start building clarity. You see stronger employee trust and sentiment, cleaner banking workforce engagement metrics, and feedback that leads to meaningful changes, not just more surveys.

Access the questions financial services leaders use to track employee sentiment

Download nowWhat good employee sentiment looks like in high-performing financial services teams

Good employee sentiment is like a well-tuned trading floor. You feel the rhythm before you read the numbers. In high-performing organizations, signals show up early, flow consistently, and guide decisions.

When leaders measure employee sentiment in financial services with the right balance, engagement, trust, and work performance reinforce each other naturally.

- Clear trust signals across teams: High engagement appears when employees share feedback freely through surveys and conversations. Building trust and engagement in BFSI organizations means employees feel safe to speak, leaders listen, and data turns into insights that strengthen customer outcomes and business stability.

- Managers act as daily connectors: The role of managers in banking employee engagement is visible when leaders translate data into action. Managers use feedback to support the current role, guide training, and improve job clarity, directly lifting the workforce engagement strategy for banks.

- Consistent listening without overload: High-performing organizations avoid survey fatigue by choosing the right balance of surveys and dialogue. Engagement grows when employees see feedback collected, reviewed, and acted on regularly, not stored. This consistency supports retention and positive work performance.

- Engagement links directly to results: Strong employee engagement KPIs for financial services connect sentiment to customer experience and business results. Leaders see how engagement drives job commitment, service quality, and retention, making engagement a core business lever, not an HR metric.

- Recognition and growth are visible: Improving employee morale in financial institutions happens when recognition and development opportunities follow feedback. Employees feel valued in their jobs, see growth paths, and stay engaged because leadership invests consistently in people and performance.

- Communication feels steady, not reactive: High-performing teams address banking workforce communication challenges early. Feedback flows both ways, leaders share context, and engagement stays positive even during change, helping organizations maintain trust during pressure.

- Data supports decisions, not noise: Effective organizations use clean data and insights from surveys to guide leadership choices. Measuring employee sentiment in financial services becomes a habit, helping leaders respond early and keep engagement high across the workforce.

Once organizations understand what strong sentiment looks like, the next step is choosing systems that sustain it. Selecting tools that match banking realities, scale feedback, and deliver insights determines how well engagement strategies hold up over time.

Choosing the right employee listening tools for financial services organizations

Choosing employee listening tools is like selecting a core banking system. If it cannot handle the real load, everything downstream breaks. A good fit helps hr managers hear financial services employees clearly, convert signals into valuable insights, and act fast. A poor fit creates noisy surveys, weak follow-through, and slower retention of talent.

- Built for financial realities, not other industries: Tools that work in other industries may miss regulated workflows. For credit unions, banks, and investment management, the right platform supports clear audits, secure access, and dependable reporting after every survey conducted.

- Designed for distributed teams and complex roles: Financial services employees span branches, call centers, and back offices. Strong tools capture employee happiness across locations and roles, without relying on one-size assumptions borrowed from commercial real estate or generic tech playbooks.

(Source: AON)

- Actionable insights, not just dashboards: The goal is not more charts. The tool must turn feedback into valuable insights hr managers can act on quickly. High voluntary turnover rates signal deep-seated issues, and without clear insight, organizations react late, not early.

- Survey design that keeps participation high: A tool should reduce drop-offs by keeping questions crisp and relevant. This matters when leaders are learning how to choose employee survey software for banks and want a clean signal from every survey conducted, not random noise.

- Flexible reporting for different leadership needs: Different leaders need different cuts of data. The right tool helps a company compare teams, locations, and time periods without extra manual work, so decisions stay fast and aligned.

- Support that matches the stakes: In financial services, time-to-action matters. The right partner supports setup, rollouts, and follow-through so hr managers can move from feedback to fixes, helping employee happiness and retaining talent stay strong.

Once the tool requirements are clear, the question becomes execution. The best platforms remove friction in how feedback is collected, analyzed, and acted on.

Next, we will look at how CultureMonkey supports sentiment measurement for financial services employees end-to-end.

How CultureMonkey supports employee sentiment measurement in financial services

CultureMonkey is like a control tower for listening. It does not just collect signals; it helps leaders route action before small issues become delays. In financial services, where pace and compliance matter, CultureMonkey makes sentiment measurement simple, reliable, and continuous, so teams see what to fix and when.

- Always-on listening, without noise: CultureMonkey runs lightweight surveys and smart pulses that capture sentiment consistently. You get clean trends, fewer drop-offs, and clearer signals across teams, helping leaders improve employee engagement without adding survey fatigue.

- White-label surveys for brand-safe listening: CultureMonkey allows surveys to run fully under your organization’s brand, with no third-party visibility. This keeps employee communication consistent, builds trust, and ensures sentiment measurement feels like an internal initiative rather than an external tool.

- Clear insights leaders can act on: Results are organized into themes and priorities, so teams move from raw responses to decisions quickly. This keeps sentiment measurement practical, reduces guessing, and makes follow-through easier for managers and HR.

- Team-level visibility for targeted fixes: CultureMonkey helps leaders see what is happening by team, location, or role. Instead of generic actions, leaders can address specific friction points that affect morale and engagement where they actually occur.

- Built for follow-through, not reporting: CultureMonkey supports ownership, next steps, and check-ins so action does not stall after the survey. That visible follow-through builds trust over time and helps improve employee engagement in a way employees actually notice.

- Lifecycle-based sentiment checkpoints: CultureMonkey enables structured listening at critical moments like onboarding, role changes, performance cycles, and post-peak periods. This helps financial services teams catch sentiment shifts early, instead of relying on annual surveys that surface issues too late.

- Confidence through anonymity and governance: Employees share more honestly when trust is clear. CultureMonkey enforces strict anonymity thresholds and role-based access, ensuring feedback stays protected while still giving leaders enough clarity to act. This balance is essential in regulated environments where privacy and credibility matter.

- Consistency across distributed, regulated teams: Whether teams are spread across branches, regions, or functions, CultureMonkey standardizes how sentiment is measured without forcing a one-size-fits-all approach.

Conclusion

Measuring employee sentiment in financial services is no longer a nice-to-have exercise. It is a core capability for organizations operating under constant pressure, regulation, and customer scrutiny. When leaders understand how people feel in real time, they can spot risks early, protect trust, and make decisions that stabilize both work performance and customer experience. Without this visibility, problems surface late, often as attrition, errors, or disengagement that is costly to reverse.

This is where CultureMonkey makes a meaningful difference. CultureMonkey helps organizations move beyond periodic surveys toward continuous, reliable listening that fits financial services realities.

By combining lightweight surveys, clear insights, and built-in follow-through, CultureMonkey turns employee sentiment into something leaders can act on, not just track. Teams gain clarity, managers gain direction, and employees see that their feedback leads to real change.

Book a demo with CultureMonkey!

FAQs

1. How do banks measure employee sentiment without risking honesty or compliance?

Banks protect honesty by combining anonymous surveys with regulatory-compliant employee surveys and clear governance. When employees understand how data is stored, used, and separated from performance reviews, trust increases. Using aggregated reporting, limited access controls, and consistent communication allows banks to collect honest sentiment without breaching compliance or exposing individual responses over time consistently across teams.

2. What is the best way to measure employee sentiment in financial services teams?

The best approach blends pulse surveys, qualitative feedback, and behavioral signals to create a full picture. Measuring employee sentiment in financial services works best when teams combine regular surveys with manager conversations and trend analysis. This balance captures how people feel, why they feel that way, and how sentiment is connected to performance and retention across roles and time.

3. How often should financial institutions track employee sentiment?

Most financial institutions benefit from tracking employee sentiment quarterly, supported by lighter monthly pulse checks. Frequency should reflect change intensity. During mergers, policy shifts, or workload spikes, more frequent listening helps leaders spot issues early. Consistent cadence matters more than volume, preventing survey fatigue while maintaining reliable trend visibility across teams, departments, and business cycles over time.

4. Can employee sentiment surveys work in highly regulated banking environments?

Yes, employee sentiment surveys can work in regulated banking environments when designed correctly. Using regulatory-compliant employee surveys, anonymity safeguards, and clear purpose statements encourages participation. Short surveys, neutral language, and transparent follow-through help employees share feedback safely, without fearing audit exposure or unintended links to performance evaluations during sensitive operational or regulatory periods of change.

5. How is employee sentiment different from employee engagement in financial services?

Employee sentiment reflects how employees feel day to day, while employee engagement reflects sustained commitment and effort. In financial services, sentiment shifts faster under pressure. Tracking both helps leaders understand immediate reactions and long-term alignment, ensuring short-term morale issues do not quietly erode engagement, performance, or retention across teams, roles, and business units over time.

6. What should HR teams do after collecting employee sentiment data in banks?

After collecting employee sentiment data, HR teams should close the loop quickly. Share key themes, assign ownership, and define next steps. Acting on feedback builds trust. Even small visible changes matter. Without follow-through, sentiment data loses credibility, participation drops, and future surveys become harder to justify across banking organizations and regulated environments over time consistently.